Medicare

What is Medicare?

Medicare is a vital program designed to provide seniors with essential health coverage as they enter retirement. Understanding Medicare is key to ensuring you receive the medical care you need, while also managing your healthcare costs effectively. As you turn 65, it’s important to explore your options and make informed decisions about your health insurance so that you can live a secure and comfortable retirement.

The 4 Parts of the Medicare Program

Part A

Hospital Coverage

This covers inpatient hospital stays, skilled nursing facility care, hospice, and some home health care. Most people get Part A premium-free if they or their spouse paid Medicare taxes for at least 10 years.

Part B

Medical Coverage

This covers outpatient care, doctor visits, preventive services, and some home health care. There is a monthly premium for Part B, which can be deducted from your Social Security payments.

Part C

Medicare Advantage

These are private insurance plans that provide all the benefits of Part A and Part B, and often include additional benefits like vision, dental, and even prescription drug coverage (Part D). These plans usually have networks of doctors and hospitals.

Part D

Prescription Drug Coverage

This part provides prescription drug coverage through private insurance plans. You pay a monthly premium, and there may be additional costs for medications.

Open Enrollment Begins October 15th!

Open Enrollment for Medicare begins October 15th and ends December 7th. As a current Medicare beneficiary, during this time you can make changes to your medical coverage, including:

Changes made during this period take effect on January 1st, 2025.

Not a current Medicare beneficiary? Read below to get started.

Before you retire, it’s a good idea to start educating yourself on the different plans and options that Medicare offers. Typically, retired or soon-to-be-retired seniors are required to enroll in Medicare during the Initial Enrollment Period (IEP). This is a 7-month window that starts 3 months before your 65th birthday, includes the month you turn 65, and ends 3 months after. If you sign up during your IEP, your coverage will start on the first day of the month you turn 65.

If you miss your IEP, you can enroll in Medicare during the General Enrollment Period (GEP), from January 1st to March 31st each year. However, your coverage won’t start until July 1st, and you may face late enrollment penalties for delaying Part B.

There are exceptions to the information above. For example, if you’re already receiving Social Security benefits when you turn 65, you may be automatically enrolled in Parts A and B of the Medicare program. Find out how to leverage Medicare to meet your specific medical needs by visiting the Get Started with Medicare page on medicare.gov.

Medicare Supplemental Insurance (Medigap)

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private health insurance company to help pay your share of out-of-pocket costs in Original Medicare. Policies are standardized, and in most states named by letters, like Plan G or Plan K. The benefits in each lettered plan are the same, no matter which insurance company sells it.

Generally, you must have Original Medicare – Part A (Hospital Insurance) and Part B (Medical Insurance) – to buy a Medigap policy.

All Medigap policies are standardized. This means, policies with the same letter offer the same basic benefits no matter where you live or which insurance company you buy the policy from. There are 10 different types of Medigap plans offered in most states, which are named by letters: A-D, F, G, and K-N. Price is the only difference between plans with the same letter that are sold by different insurance companies.

In some states, you may be able to buy another type of Medigap policy called Medicare SELECT. If you buy a Medicare SELECT policy, you have the right to change your mind within 12 months and switch to a standard Medigap policy.

NOTE: In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. If you live in one of these states, please contact your State Health Insurance Assistance Program (SHIP) or State Department of Insurance for more information on purchasing a Medigap policy.

Do you receive supplemental benefits through your Medicare Advantage plan? We want to hear from you!

If you receive supplemental benefits such as vision, dental or hearing coverage, transportation, wellness benefits, nutrition assistance, or any other supplemental benefit through your Medicare Advantage plan, we would like you to share your story with us! Please click the button below to be taken to our survey – it should only take about three minutes to complete!

Printable Resources and Information

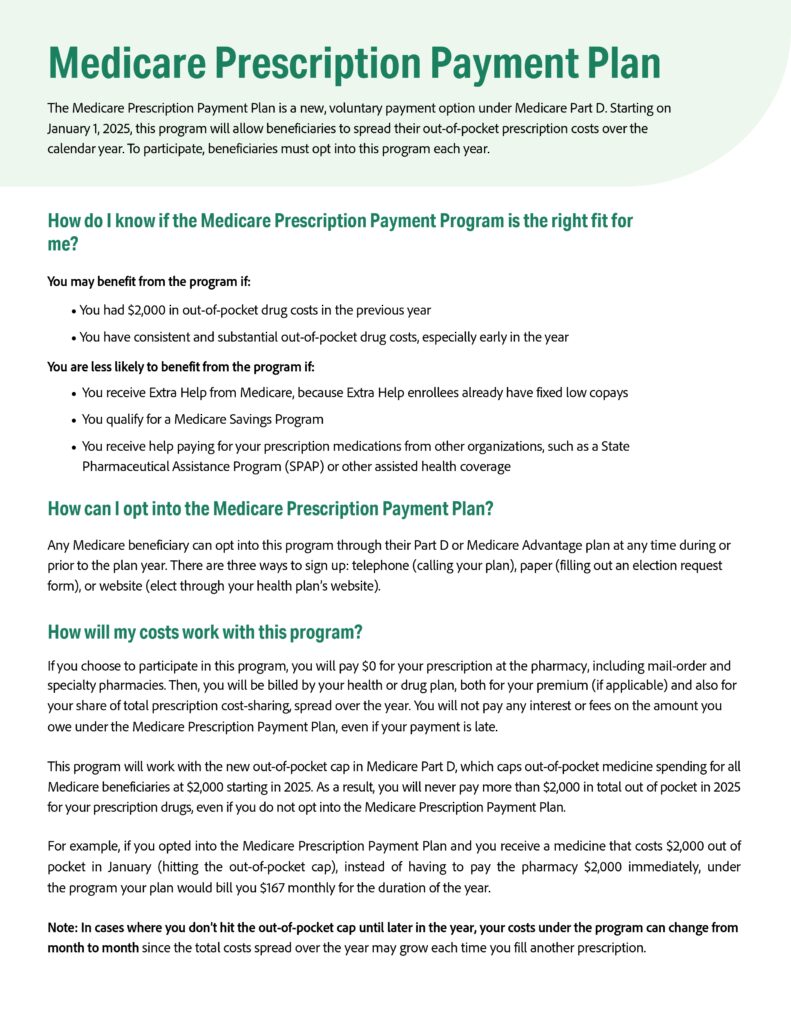

PSA: New Changes Will Help Medicare Beneficiaries Afford Prescription Drug Costs

Congress has made recent changes to Medicare Part D that will help current beneficiaries manage their out-of-pocket costs and make prescription drugs more affordable, beginning in 2025. However, action is required on your part to take full advantage of these new benefits. Watch the PSAs below – brought to you by the Alliance for Aging Research – for more info.